LET'S GET THE RIGHT PRICE

FOR YOUR PROPERTY

ABOUT

MY PROFESSIONAL STANDARDS AND PERSONAL VALUES

Derek Tan

Condominium and HDB Specialist

Focused in residential buying and selling with an emphasis on marketing properties as well as consulting for investing purposes.Derek believes the foundation of trust is built upon transparency. He prefers to be open about his conception to both friends and clients alike, not just by telling them the good things, but the possible pitfalls to look out for, wanting them to make the most informed decisions and succeed in life.It is not just about the numbers, but the personal and professional values that should be upheld.

SERVICES

My only purpose is to deliver successful results

TIMELINE PLANNING

COMPARATIVE MARKET ANALYSIS

FINANCIAL & PROPERTY ASSET MANAGEMENT

DIGITAL MARKETING

PHOTOSHOOT + VIDEOSHOOT

HOME TOUR VIDEO

Achieve wider outreach with professional video marketing

360 VIRTUAL TOUR

Boost listings and attract genuine inquiries

Testimony from Derek's Client

We choose Derek as our realtor even though we have family friends who are in this industry because we needed a professional who can give us unbiased advices and confidentiality in our finances. He helped us to sell our low floor 5 room HDB that's facing a busy road at Bt Batok and moved to a high floor Executive Apartment in Bt Panjang.Our timeline was tight as we needed at least 3 months for a full scale renovation, he arranged over 20 viewings in 2 days and found our ideal home with no COV + early handover! He is very committed and made the process super easy for us.- Suhaini and Family -

Derek helped us to successfully appeal to CPF Board to utilize the proceeds from the sale of our small 3 Room HDB in Yishun to a larger 4 Room HDB in Woodlands. As my son was 55 years old at the time and didn't fulfil the Full Retirement Sum, part of the proceeds would have ended up in his CPF Retirement Account.In the end, we were able to purchase the 4 Room flat fully paid for and without using any cash as he sold our 3 Room flat above market valuation and we were also eligible for HDB grant. We were impressed by his prompt replies and always so helpful in our requests, as we are not familiar with many things regarding the transactions. He is reliable, competent and one that I can recommend to my friends and family.- Mr Lau & Mdm Tan -

I previously engaged other agents for 1 month prior to giving Derek the chance to market my unit because I couldn't find a good price. He took just 3 days to fetch a price that was $55,000 above valuation.The extra fund helped me towards my retirement as I downgrade from my 5 room HDB in Bt Panjang to a 3 room HDB in Queenstown. Since I stay alone, a smaller size flat and nearer location to the city would be ideal for me. He was very professional and attended to all my queries from the start to the end.- Mdm Fong -

TRACK RECORDS

Using proven methods and transact the property successfully

997c buangkok cres

5 room | mid floor | sold in 1 DAYRECORD PRICE

22 tEBAN GARDENS

4 ROOM | MID fLOOR | SOLD IN 1 MONTHRECORD PRICE

410 SAUJANA RD

5 room | mid floor | sold IN 3 DAYS$55,000 ABOVE HDB VALUATION

698A JURONG WEST CENTRAL 3

3 ROOM | MID fLOOR | SOLD IN 2 WEEKSRECORD PRICE

Maysprings

3 BEDROOMS | hIGH fLOOR | SOLD IN 5 WEEKS

659C PUNGGOL EAST

4 ROOM | MID fLOOR | SOLD IN 6 DAYS

RECORD PRICE

780A WOODLANDS CRES

3 room | HIGH floor | sold IN 1 WEEK

102 GANGSA RD

3 ROOM | LOW fLOOR | SOLD IN 2 WEEKS

22 SIN MING RD

3 ROOM | LOW fLOOR | SOLD IN 2 VIEWINGS

153 GANGSA RD

5 ROOM | LOW fLOOR | SOLD IN 2 MONTHSRECORD PRICE

316B YISHUN AVE 9

4 ROOM | MID fLOOR | SOLD IN 3 WEEKSRECORD PRICE

443A BUKIT BATOK WEST AVE 8

5 ROOM | LOW fLOOR | SOLD IN 6 WEEKS

294 CHOA CHU KANG AVE 2

4 ROOM | HIGH fLOOR | SOLD IN 1 MONTH

424A YISHUN AVE 11

3 ROOM | MID fLOOR | SOLD IN 1 VIEWING

813A YISHUN RING RD

3 ROOM | HIGH fLOOR | SOLD IN 3 MONTHS$15,000 ABOVE HDB VALUATION

461 SEGAR RD

4 ROOM | HIGH fLOOR | SOLD IN 1 WEEKHIGHEST TRANSACTED

Credentials and Happy Clients

Contact Derek for a non-obligatory discussion and find out how he achieves the highest possible price for your unit.

GET YOUR FREE CONSULTATION NOW

Derek Tan

9747 0830

CEA NO. R064584H

Let Me Assist You in Your Real Estate Journey

Address: PropNex Limited 480 Lorong 6 Toa Payoh, #18-01 HDB Hub East Wing Lift Lobby 2, S310480

Disclaimer: The case studies are for educational use only and we make no representation or warranties with respect to the accuracy, applicability, or completeness of its contents. Any forward-looking statements outlined in this landing page are simply our opinions, estimates, expectations or forecasts for future potential, and thus are not guarantees or promises for actual performance. As required by law, we can make no guarantees that you will achieve any results. Results will vary from case to case.In adherence to the Personal Data Protection Act, by submitting your personal particulars through the forms in this website, you are hereby agreeing to allow us to contact you via the contact information you have provided.Copyright © 2024 Derek Tan. All rights reserved.No part of this site may be reproduced or reused for any other purposes whatsoever without our prior written permission.

MOP OUTLINE

What Is Minimum Occupation Period(MOP)?

According to HDB, Minimum Occupation Period (MOP) is the required time frame we need to stay in a flat before resale. Typically, it lasts for about five years, and it is calculated from the day we collect our keys from HDB.

What Are the Limitations During MOP?

- You have to occupy the flat for a number of years (generally 5 years, 10 years for prime region flats) before you can sell it in the open market.

- Renting out the entire HDB flat is illegal, but you can rent out one room less than the total number of rooms.

I Have Fulfilled the MOP, What’s Next?

How do I know what's best for me?

Every household has unique and different requirements, there are no one size fits all strategy. As an experienced and trained realtor, Derek will firstly understand your plans, then incorporate the best solution for your needs using advanced data research, to ensure you make informed decisions in your real estate journey.

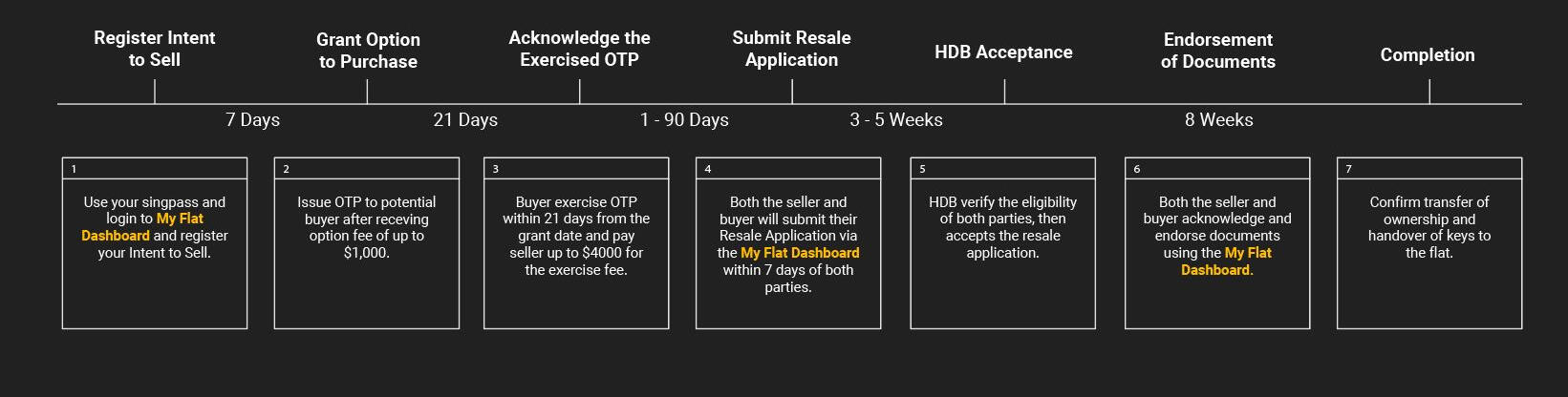

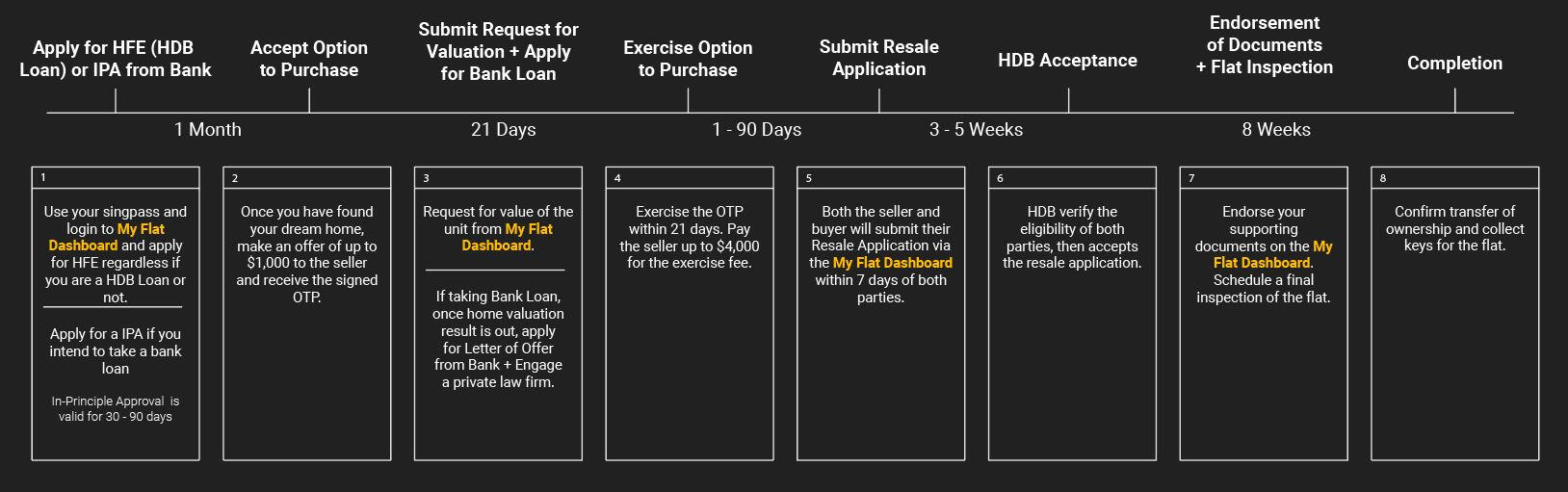

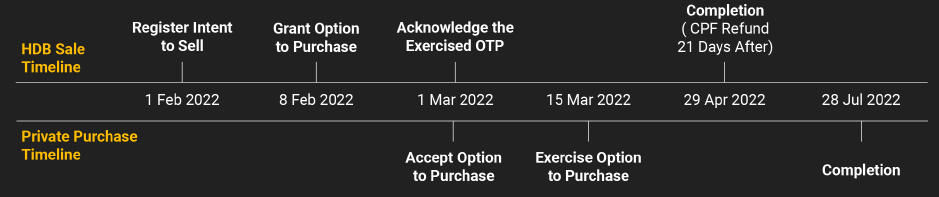

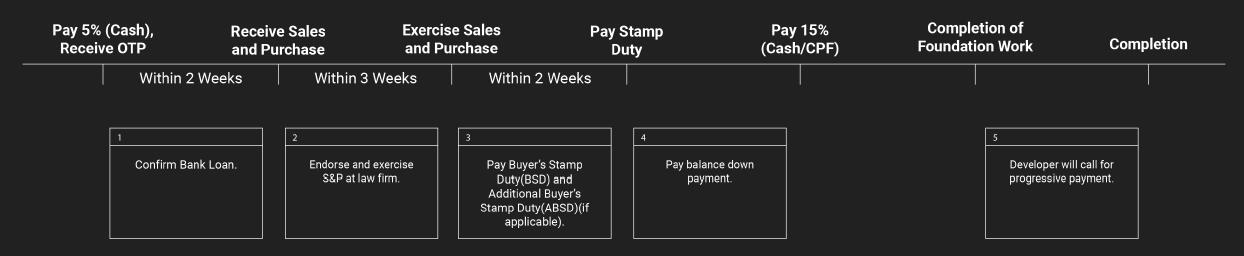

PROPERTY TIMELINE

GET YOUR FREE CONSULTATION NOW

Derek Tan

9747 0830

CEA NO. R064584H

My job is to get the highest possible price for your unit

Address: PropNex Limited 480 Lorong 6 Toa Payoh, #18-01 HDB Hub East Wing Lift Lobby 2, S310480

Disclaimer: The case studies are for educational use only and we make no representation or warranties with respect to the accuracy, applicability, or completeness of its contents. Any forward-looking statements outlined in this landing page are simply our opinions, estimates, expectations or forecasts for future potential, and thus are not guarantees or promises for actual performance. As required by law, we can make no guarantees that you will achieve any results. Results will vary from case to case.In adherence to the Personal Data Protection Act, by submitting your personal particulars through the forms in this website, you are hereby agreeing to allow us to contact you via the contact information you have provided.Copyright © 2024 Derek Tan. All rights reserved.No part of this site may be reproduced or reused for any other purposes whatsoever without our prior written permission.

Popular Searches

23 Oct 2024

HDB Loan or Bank Loan: Which is the Right Choice for You?

Choosing the right financing option for your home purchase is a pivotal decision that can significantly impact your financial future. When it comes to home financing options in Singapore, the debate often revolves around whether to opt for an HDB loan or a bank loan. Understanding the nuances of each can help you make an informed choice that aligns with your financial goals and circumstances.

Understanding the Basics: HDB Loan vs. Bank Loan

At the heart of the decision between an HDB loan and a bank loan lies the difference in interest rates and downpayment requirements. HDB loans come with a fixed interest rate of 2.6% per annum, offering stability and predictability, which can be beneficial for long-term financial planning. In contrast, bank loans offer variable interest rates, typically ranging from 1.2% to 3% per annum, which can be more attractive for those looking to minimize interest costs over time. However, these rates are subject to change according to market conditions and are often tied to rates like the Singapore Overnight Rate Average (SORA) (SingSaver).

Eligibility Criteria: Who Qualifies for What?

Eligibility is another critical factor in the HDB loan or bank loan comparison. HDB loans are specifically designed for Singaporean citizens purchasing HDB flats, with additional criteria concerning income ceilings and ownership of other properties. Conversely, bank loans are available to a broader audience, including Permanent Residents and foreigners, and can be used for a wider range of properties (BizTech Community). This flexibility makes bank loans appealing to those who do not meet the stringent criteria for HDB loans.

HDB Grant Application Process

First-timer families and singles have distinct provisions under the HDB housing grants scheme. For singles, the Enhanced CPF Housing Grant (EHG) offers up to $60,000, as noted by the Housing & Development Board. These provisions aim to ensure that single applicants are equally supported in their journey to homeownership.

Can CPF Savings be Used for Both HDB and Bank Loan Downpayments?

CPF savings can be used to cover the entire downpayment for an HDB loan, which is set at 25%. For bank loans, while CPF can be used, there is a mandatory 5% cash portion required as part of the 25% downpayment. This distinction is crucial for budgeting and financial planning, as noted by MoneySmart.

Repayment Terms: Weighing the Pros and Cons

The repayment terms associated with each loan type also differ. HDB loans offer a maximum loan tenure of up to 25 years or until the buyer reaches the age of 65, whichever is shorter. Bank loans, however, can extend up to 30 years, providing a longer period to spread out payments (omy.sg). This extended tenure could mean lower monthly payments, but it also means paying more interest over the life of the loan.

Weighing the Financial Implications

When deciding between an HDB loan and a bank loan, it is crucial to consider the long-term financial implications. While the lower interest rates of bank loans might seem attractive initially, the variable nature of these rates can lead to fluctuations in monthly repayments, affecting your budget. On the other hand, the stability of HDB loan interest rates provides predictable payments, which can be easier to manage over time (Roshi Blog).

Conclusion: Making an Informed Decision

Ultimately, the choice between an HDB loan and a bank loan should be guided by your financial situation, future plans, and risk appetite. Those who prioritize certainty and meet the eligibility criteria may find HDB loans to be the better option. Meanwhile, individuals who are comfortable with market fluctuations and seek potentially lower interest rates might prefer bank loans. By thoroughly evaluating your circumstances and considering the factors discussed above, you can make a decision that best suits your needs and financial goals.

22 Oct 2024

Latest Updates on HDB Housing Grant Eligibility:

What You Need to Know

Introduction to HDB Housing Grants

In Singapore, homeownership is a significant milestone, and the Housing & Development Board (HDB) plays a crucial role in facilitating this dream. One of the primary ways HDB supports potential homeowners is through various housing grants. These grants are designed to make purchasing a home more affordable and accessible, particularly for first-time buyers. Understanding the latest updates on HDB housing grant eligibility is essential for anyone considering buying an HDB flat.

Overview of Recent Changes in HDB Housing Grant Eligibility

Enhanced CPF Housing Grant (EHG) Details

The Enhanced CPF Housing Grant (EHG) has seen significant improvements to better support first-time home buyers. As of August 2024, the maximum grant amount has been increased to $120,000, applicable for both Build-To-Order (BTO) and resale flat purchasers. This enhancement aims to alleviate the financial burden for young families and singles stepping into the property market. According to Dollars and Sense, the EHG is based on a household's average monthly income, ensuring that the grant is distributed equitably among eligible applicants.

Changes in CPF Housing Grant for Resale Flats

Significant changes have also been made to the CPF Housing Grant for Resale Flats. Eligible first-timer families now receive an increased grant of $80,000 for 2-room to 4-room resale flats, and $50,000 for 5-room or larger resale flats. This change reflects the government's ongoing commitment to make homeownership more attainable. As reported by Dollars and Sense, these adjustments are part of a broader strategy to support diverse housing needs across different family sizes.

Current Eligibility Criteria for HDB Housing Grants

Income Assessment Period Adjustments

The income assessment period for HDB buyers has also been revised to ensure fairer grant allocation. As detailed by The Straits Times, this change is part of a series of updates to the housing grant disbursement process, reflecting a more dynamic approach in evaluating applicants' financial situations.

First-Timer Families and Singles Provisions

First-timer families and singles have distinct provisions under the HDB housing grants scheme. For singles, the Enhanced CPF Housing Grant (EHG) offers up to $60,000, as noted by the Housing & Development Board. These provisions aim to ensure that single applicants are equally supported in their journey to homeownership.

HDB Grant Application Process

Step-by-Step Guide to Applying for HDB Grants

Applying for HDB housing grants involves several steps. First, applicants must check their eligibility criteria, which includes income ceilings and family nucleus requirements. Once eligibility is confirmed, applicants can proceed with their grant application through the My HDBPage portal. This streamlined process is designed to be user-friendly, ensuring that applicants can easily navigate the system.

Common Mistakes to Avoid During Application

One common mistake applicants make is not accurately reporting their household income, which can affect eligibility. Additionally, failing to submit necessary documentation on time can delay the application process. As highlighted by PropertyGuru, being thorough and timely in your application submission is crucial to securing the grant successfully.

Impact of HDB Grant Changes on Home Buyers

Financial Implications for First-Time Home Buyers

The recent changes in HDB housing grants have profound financial implications for first-time home buyers. The increased grant amounts mean that buyers can potentially reduce their mortgage load, making homeownership more financially viable. This aligns with the government's broader objectives to support citizens in achieving their housing aspirations.

Effects on the Real Estate Market in Singapore

These updates to HDB housing grants are likely to have a ripple effect on the real estate market in Singapore. By making homes more affordable, demand for HDB flats may increase, potentially stabilizing property prices. This is part of a strategic move to balance the market dynamics and ensure sustainable growth in the housing sector.

22 Oct 2024

Selling a Flat After Age 55: HDB and Private Owners

Selling an HDB flat after age 55 involves a unique set of challenges and opportunities, especially when the property has been financed using CPF funds. Understanding the current market trends and regulations can significantly impact the selling process and the financial planning for your future.

Understanding CPF Refund Requirements

According to CPF Board, If you are below age 55, the refunds will be credited to your Ordinary Account. If you are 55 years old or older, your refunds will be first used to top up your Retirement Account (RA) to your FRS. Any balance housing refund will remain in your OA.Upon selling your property, you will need to refund the following to your CPF accounts:· The CPF principal amount (P) you have withdrawn to pay for the property;· The accrued interest (I) —this is the amount you would have earned if these savings were left in your OA; and· If you have pledged the property to make up your Full Retirement Sum (FRS), this amount will need to be refunded together with the P+I.

15-Month Wait-Out Period for Private Homeowners

Private homeowners aged 55 and above face a 15-month wait-out period if they wish to purchase a four-room or smaller HDB resale flat after selling their private property. This regulation, effective since September 2022, aims to manage the demand in the HDB resale market and ensure fair access to public housing.

Market Trends and the Value of Older HDB Flats

Contrary to common perceptions, older HDB flats do not depreciate as quickly as many believe. Recent data shows that these properties maintain their value better than expected, partly due to the demand for resale flats and the various upgrading programs initiated by the HDB. This trend is encouraging for owners looking to sell older flats, as it suggests that there is still substantial value to be realized from these properties over time.

The private property market in Singapore offers a range of choices for single PRs. Condominiums, in particular, are popular due to their facilities and potential for capital appreciation. Investing in private property can be a strategic move for those seeking long-term residence in Singapore without the limitations imposed by HDB regulations (PropertyGuru Singapore).

The Lease Buyback Scheme: An Alternate Option

For those aged 65 and older, the Lease Buyback Scheme presents an interesting opportunity. This scheme allows homeowners to sell a portion of their flat's lease back to the HDB while retaining a lease period of 15 to 35 years. Since its launch in 2009, approximately 9,700 households have participated in this scheme, which provides a viable option for senior citizens looking to unlock the value of their homes without having to relocate.

Strategic Considerations for Selling

For those considering selling their HDB flats after age 55, it's crucial to understand that only the funds in CPF OA can be used for your future housing needs. If you have yet to fulfil your Full Retirement Sum and seeking to avoid your RA from retaining the funds after selling your current flat for your future housing needs, you should consider selling your flat before age 55.In summary, selling an HDB flat after age 55 requires careful planning and consideration of various factors, from CPF fund management to understanding market dynamics. Engaging with real estate professionals and financial advisors can provide valuable insights and help navigate the complexities of the process, ensuring that your financial and housing needs are met effectively.

24 Oct 2024

Can a Single PR Buy a Resale HDB?

Navigating the intricate web of property purchase rules in Singapore is a crucial task for a single Permanent Resident (PR) eyeing a resale HDB flat. Unfortunately, under current regulations, a solo PR is ineligible to purchase an HDB resale flat. The pathway for ownership requires partnership with another PR or a Singapore Citizen (SC), facilitated through the HDB Public Scheme or the Fiancé/Fiancée Scheme. This collaboration ensures compliance with eligibility criteria, including citizenship and relationship status, aligning with Singapore’s strategic housing policies aimed at prioritising citizens. Consequently, exploring private property might be a viable alternative for single PRs seeking ownership.

Understanding HDB Resale Eligibility for Single PRs

According to the latest guidelines, a single PR cannot independently buy a resale HDB flat. The Housing and Development Board (HDB) rules stipulate that a PR can only purchase a resale flat in partnership with another PR or SC. This is possible under specific schemes such as the HDB Public Scheme or the Fiancé/Fiancée Scheme. These schemes mandate that the purchase must involve a family unit or a couple intending to marry.

HDB Public Scheme and Fiancé/Fiancée Scheme Explained

Under the HDB Public Scheme, a PR can purchase a resale flat with family members, which can include a spouse, children, siblings, or parents. Alternatively, the Fiancé/Fiancée Scheme allows a PR to buy with a partner they intend to marry. These schemes ensure that the housing needs of both PRs and citizens are balanced, reflecting Singapore’s housing policies (Eligibility Singapore PR).

Alternative Housing Options for Single PRs

Given the restrictions on purchasing resale HDB flats independently, single PRs may consider alternative housing options. One feasible option is investing in private residential properties, such as condominiums. Private properties are not subject to the same stringent eligibility criteria as HDB flats and can be a sound investment, especially those located in prime areas with good amenities (PropertyGuru Singapore).

Exploring the Private Property Market

The private property market in Singapore offers a range of choices for single PRs. Condominiums, in particular, are popular due to their facilities and potential for capital appreciation. Investing in private property can be a strategic move for those seeking long-term residence in Singapore without the limitations imposed by HDB regulations (PropertyGuru Singapore).

Impact of Current Policies on PR Housing Opportunities

The existing policies reflect Singapore’s approach to prioritising citizens in public housing. By requiring PRs to purchase resale flats only in partnership with citizens or other PRs, the government aims to maintain a balance in the housing market. This policy ensures that public housing primarily benefits Singaporeans, while still providing avenues for PRs to own property through collaboration

For single PRs, the focus might shift towards private property investments, which can offer more flexibility and fewer restrictions. This shift underscores the importance of understanding the evolving landscape of Singapore’s property market and leveraging available opportunities effectively.

24 Oct 2024

HDB COV Explained: How It Affects Singaporean Homeowners

When navigating the complex landscape of Singapore's HDB resale market, understanding Cash Over Valuation (COV) is essential. COV refers to the extra cash amount that a buyer pays over the HDB's official valuation of a resale flat. This payment must be made in cash, as it cannot be financed through home loans or CPF savings, making it a critical factor in the home buying process.

What is HDB COV?

Cash Over Valuation (COV) is the difference between the sale price of a resale HDB flat and its official valuation by HDB. If the purchase price exceeds the valuation, the buyer incurs COV, which must be paid in cash. This amount cannot be covered by loans, CPF, or grants, adding a layer of financial consideration for prospective homebuyers. According to Ohmyhome, COV has become a pivotal aspect of the HDB resale market, influenced by various factors including market demand and location.

The Impact of COV on Homebuyers

Understanding the impact of COV is crucial for Singaporean homebuyers. The primary financial implication is that it directly affects the Buyer's Stamp Duty, a tax imposed on property buyers based on the purchase price or market value of the property, whichever is higher. As explained by PropertyGuru, since COV cannot be financed by CPF or bank loans, it requires careful financial planning. With rising inflations and renovations cost, home buyers are generally cautious of paying high COV as the cash could be used for other housing needs e.g furnitures, renovations.

Factors Influencing COV

Several factors can influence the amount of COV in the HDB resale market. These include the property's location, neighbouring schools, access to amenities, transportation, the overall demand for housing, rarity, and the specific features of the flat. Properties in prime locations or those with unique attributes tend to attract higher COVs.

Strategies for Managing COV

For those considering purchasing a resale HDB flat, managing COV effectively is vital. One strategy is to conduct thorough research on the unit's market indicative value and engage in negotiations to potentially lower the COV. Additionally, being aware of market trends and seeking advice from real estate experts can provide insights into managing COV. Pinnacle suggests that understanding market conditions and being prepared to walk away from a deal can empower buyers in the negotiation process.

20 Oct 2024

BTO vs Resale: Which is Right for You?

Deciding between a Build-To-Order (BTO) flat and a resale property is a significant choice for Singaporean homebuyers. With the Singapore real estate market offering diverse options, understanding the pros and cons of each can help in making an informed decision. BTO flats are often favored for their affordability due to government subsidies, while resale flats offer immediate availability and potential negotiation opportunities.

The Appeal of BTO Flats in Singapore

BTO flats are typically more affordable than resale flats in the same area. This is largely due to the government subsidies that significantly lower the purchase price. For instance, a BTO flat launched in Tampines might be priced much lower than its resale counterpart, providing a cost-effective option for many buyers (DollarsAndSense.sg). Additionally, a BTO flat comes with a fresh 99-year lease, offering long-term security for homeowners.

Advantages of BTO Flats

Lower Purchase Price Due to Government Subsidies: The affordability of BTO flats is a major draw, especially for first-time homebuyers who are mindful of budget constraints (Ohmyhome).Fresh 99-Year Lease Tenure: With a 99-year lease, BTO flats offer a full lifespan of ownership, which can be appealing for long-term investment.Modern Amenities: Newer BTO projects often include modern amenities and facilities, enhancing the living experience.

Disadvantages of BTO Flats

Longer Waiting Time for Completion: One downside to BTO flats is the waiting time. Buyers often have to wait several years for their flats to be completed, which can be a significant drawback for those needing immediate housing.Limited Locations and Designs: BTO flats are also limited in terms of location and design options. They are typically built in new towns or estates, which may not be as desirable for some buyers compared to more established areas.Modern Amenities: Newer BTO projects often include modern amenities and facilities, enhancing the living experience.

Advantages of Resale Flats

Immediate Occupancy: Resale flats eliminate the waiting time, allowing buyers to move in as soon as the transaction is complete.Established Neighborhoods: These flats are often located in mature estates with established amenities like schools, shopping centers, and public transport, providing convenience and accessibility.Potential for Negotiation: Unlike BTOs, resale flats allow for price negotiation, which can result in more favorable purchase terms.

Disadvantages of Resale Flats

Potentially Higher Costs: Resale flats are generally more expensive due to market factors even though there are more CPF grants available for first time buyers.Shorter Lease Tenure: Another drawback is the older lease tenure associated with resale flats. Depending on the age of the flat, the remaining lease could be significantly shorter than a new BTO flat, potentially affecting future resale value and financing options.Possible High Renovation Cost: BTO are brand new and may require lesser work to be done as it does not require as much hacking work as compared to a resale flat that’s in poor or original condition.

Making the Right Choice: BTO and Resale Comparison

When comparing BTO vs resale, the decision often hinges on individual priorities. For those prioritizing budget, a BTO flat might be the more suitable option, thanks to its lower purchase price and government subsidies. However, if immediate occupancy and location in a mature estate are more important, a resale flat would be advantageous.Ultimately, understanding the pros and cons of BTO and resale options is essential for Singaporean homebuyers. By carefully considering factors such as budget, timeline, and location, buyers can find the ideal living space that meets their needs and preferences in the dynamic housing market of Singapore.

20 Oct 2024

Newly Launched vs Pre-Owned: A Fresh Take on Condo Investments

Investors in the condominium market face a significant decision: newly launched versus pre-owned condos. This choice can significantly influence their investment outcomes, as both options come with distinct advantages and challenges.

The Allure of Newly Launched Condos

Newly launched condos are a beacon for many investors due to their modern amenities and developer incentives. These properties often feature cutting-edge designs and facilities that cater to contemporary lifestyles.As noted by PLB Insights, new condos come with minimal renovation costs and are more aligned with the preferences of today's buyers. Additionally, developers frequently offer enticing incentives, which can include luxurious furnishings and exclusive discounts, making these investments particularly attractive (Ohmyhome).However, it's essential to consider that new condos are typically priced higher than their pre-owned counterparts. This price premium reflects the state-of-the-art amenities and the allure of owning a brand-new property. Furthermore, new launches may take several years to complete, delaying potential rental income (CityRealty).

The Advantages of Pre-Owned Condos

On the flip side, pre-owned condos offer several compelling benefits. One of the primary advantages is the potential for immediate occupancy, which can be particularly appealing for investors looking to generate rental income quickly (99.co). In some cases, resale condos may already have tenants, providing a seamless transition for investors. Additionally, pre-owned condos often present opportunities for price negotiation. Unlike new launches, where prices are typically fixed by developers, resale properties allow for more flexibility based on the seller's circumstances (Stacked Homes). This can result in a more favorable purchase price, potentially leading to higher gains upon resale.

Market Conditions and Investment Goals

Ultimately, the decision between newly launched and pre-owned condos should align with the investor's goals and the current market conditions. For those prioritizing modern amenities and immediate incentives, newly launched condos might be the right choice. Conversely, investors seeking immediate returns and negotiation flexibility might find pre-owned condos more appealing. It's crucial to conduct thorough market research and consider factors such as location, demand, and economic trends. This will help investors make informed decisions that align with their financial objectives and risk tolerance.

18 Oct 2024

Freehold vs Leasehold: Which is Better?

Overview of the Singapore Property Market

The Singapore property market is renowned for its robust growth and stability, attracting both local and international investors. However, with limited land availability, the choice between freehold and leasehold properties becomes critical. Freehold properties offer perpetual ownership, making them appealing for those seeking long-term security and generational wealth. Meanwhile, leasehold properties, typically with a 99-year lease, revert to the state after the lease period, often providing a more affordable entry point into the market. (Propertyguru)

Definition and Characteristics of Freehold Properties

Freehold properties in Singapore provide owners with perpetual ownership of both the land and the building. This means the property can be passed down through generations without the need for lease renewal, offering unmatched long-term stability and control.

Advantages of Owning Freehold Property

One of the primary advantages of owning a freehold property is the security it offers. Owners have full rights to the land indefinitely, which can be a significant factor in estate planning and wealth transfer. Additionally, freehold properties often appreciate in value over time, providing a solid return on investment.

Challenges and Considerations for Freehold Ownership

Despite their benefits, freehold properties tend to be more expensive than leasehold options, which can be a barrier for some buyers. Additionally, the scarcity of freehold land in Singapore can limit availability, making it a competitive market for prospective buyers.

Definition and Characteristics of Leasehold Properties

Leasehold properties come with a fixed lease period, commonly 99 years, at the end of which ownership reverts to the state. This type of property is generally more affordable and can offer potential rental income, making it attractive to investors and first-time buyers.

Benefits of Leasehold Properties

The affordability of leasehold properties is a significant benefit, allowing more individuals to enter the property market. They can also provide rental income, which can be used to offset mortgage costs or generate additional revenue.

Challenges Associated with Leasehold Properties

One of the main challenges of leasehold properties is the depreciation of value as the lease period decreases. This can impact long-term investment strategies and may require careful planning to maximize returns. (99.co)

Comparing Freehold and Leasehold Properties

Cost Implications and Affordability

Freehold properties generally command higher prices due to their perpetual ownership benefits, while leasehold properties offer a more affordable alternative. This cost difference can influence the choice based on budget constraints and investment goals.

Flexibility and Investment Potential

Leasehold properties offer greater flexibility in terms of rental opportunities and lower upfront costs, which can be advantageous for investors seeking to diversify their portfolios. However, freehold properties provide a level of stability and control that is unmatched, appealing to those with long-term investment horizons.